It’s an age-old question asked by men and women all over the world: Does size really matter?

When trading, it matters a lot! Size Does Matter in the Markets!

Position sizing could very well be the most important aspect of a trading system, yet, like expectancy, it’s rarely covered in trading books. A position sizing model simply tells you ‘how much’ or ‘how big’ of a position to take. Position sizing can be the key factor in whether or not you stay in the game or whether your gains are huge or minimal.

In this article, we will evaluate the effects of position sizing on a popular options trading strategy (selling out-of-the-money strangles).

We will show how easy it is to evaluate the impact of position sizing using the OptionStack platform.

Sign Up Today!

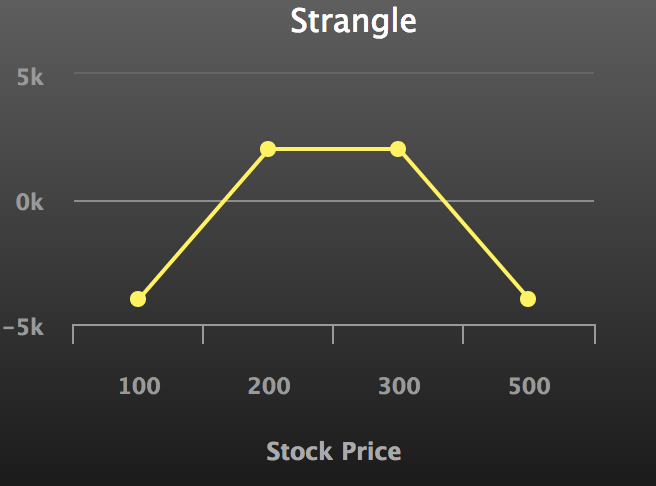

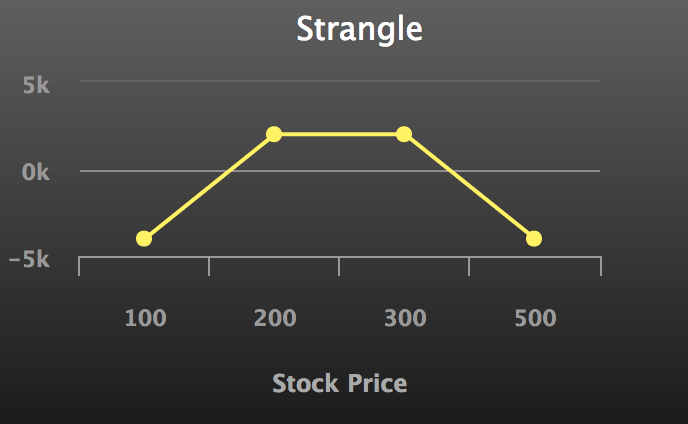

Short Strangle

The short strangle is a neutral strategy in options trading that involve the simultaneous selling of a slightly out-of-the-money put and a slightly out-of-the-money call of the same underlying stock and expiration date.

The short strangle is a limited profit, unlimited risk options trading strategy that is taken when the options trader thinks that the underlying stock will experience little volatility in the near term.

Position Sizing

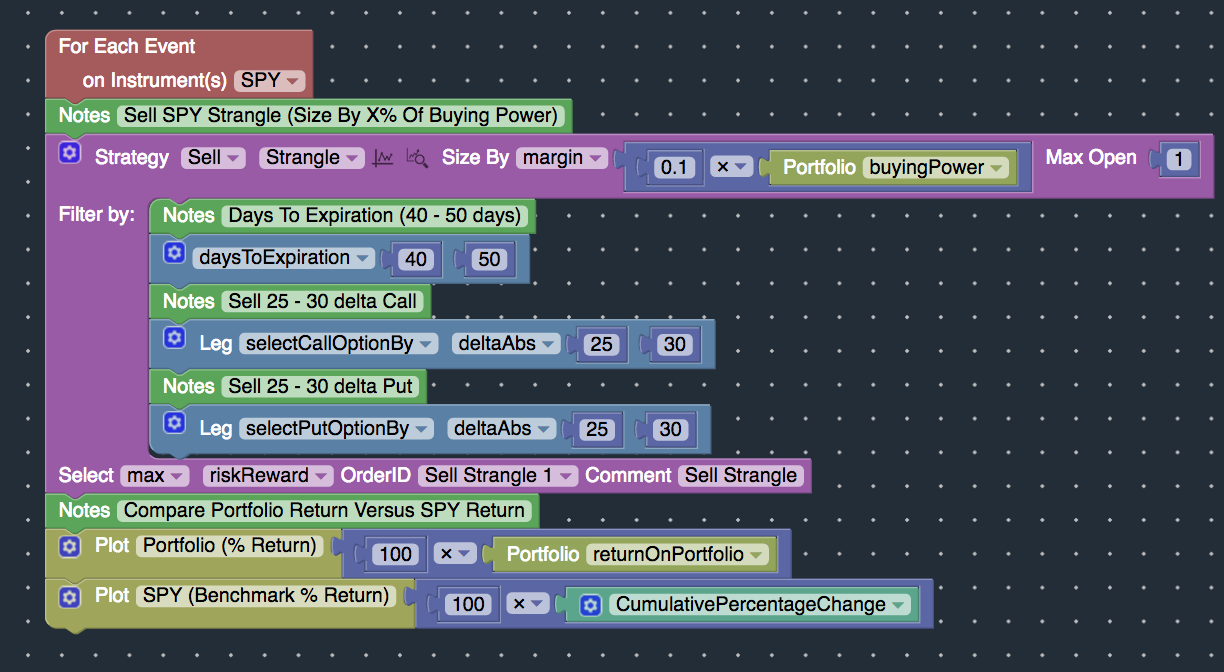

Let’s backtest the performance of various different position sizes when selling strangles. We will backtest the following:

- Sell Strangles with 10% of available buying power

- Sell Strangles with 20% of available buying power

- Sell Strangles with 50% of available buying power

All Strangles will have the identical entry / exit rules:

- Underlying Instrument: SPY

- Days To Expiration: 40 – 50 days

- Short Call: 25 – 30 delta

- Short Put: 25 – 30 delta

- Hold the strangles to expiration

The only difference will be the number of contracts / position size of the strangles.

The OptionStack platform makes it easy to adjust the position size. We will Size By the Margin of the short strangles, allocating from 10% of buying power to 50% of buying power.

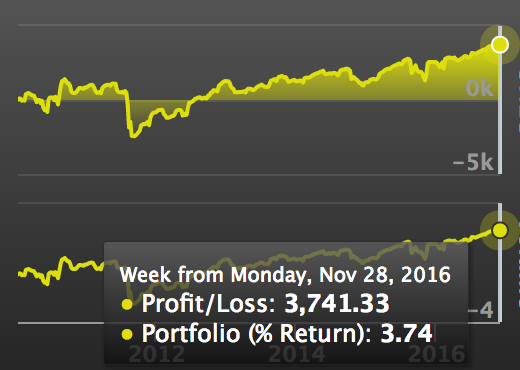

Backtest Results

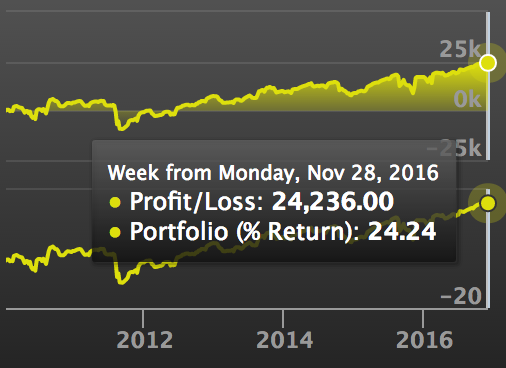

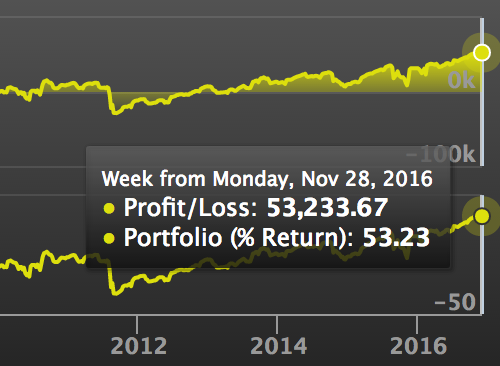

The strategies were backtested over a 6 year period. The results are displayed above. As you can see from the charts above, the difference in position size of the strangle resulted in a large variation in performance.

So when it comes to trading, size does indeed matter! Size matters a lot in the markets!

Subscribe Now!

If you want to evaluate how position sizing can affect your trading strategies, OptionStack makes it easy to analyze the impact of position sizing. Sign up now to get started!