Trading Around Earnings

Earnings season can provide ample profit opportunities, but using the wrong trading strategy can just as easily spell disaster.

For most traders seeking to profit during earnings season, there are two basic schools of thought:

- Take advantage of potentially higher implied volatility

- Take advantage of a price move without getting hurt by implied volatility.

General Observations

- Implied volatility often spikes before earnings announcements, generally causing calls and puts to increase in value. However, those increases could be partially or completely offset by large price moves in the underlying stock.

- Implied volatility declines after earnings announcements, generally causing calls and puts to decrease sharply in value. However, those decreases could be partially or completely offset by large price moves in the underlying stock.

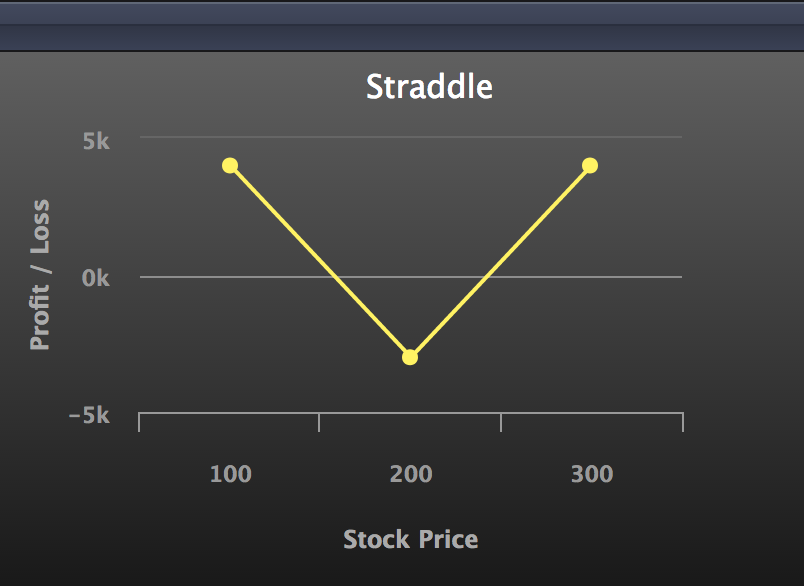

- Strategies that may benefit from an increase in implied volatility include: long straddle / strangle, ITM credit vertical spread (bull put spread, bear call spread), short butterfly, short condor, ratio back-spread.

- Strategies that may benefit from a decrease in implied volatility include: short straddle / strangle, ITM debit vertical spread (bear put spread, bull call spread), long butterfly, long iron condor, ratio spread.

Using OptionStack, you can easily backtest various earnings strategies, including trading straddle, vertical spread, iron condor, etc..

Example

One popular strategy used by retail and institutional traders is to buy and sell a straddle around earnings announcements.

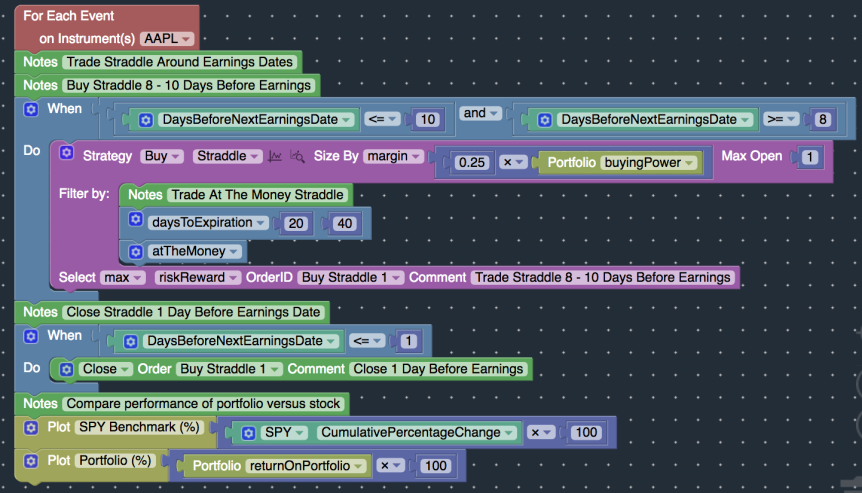

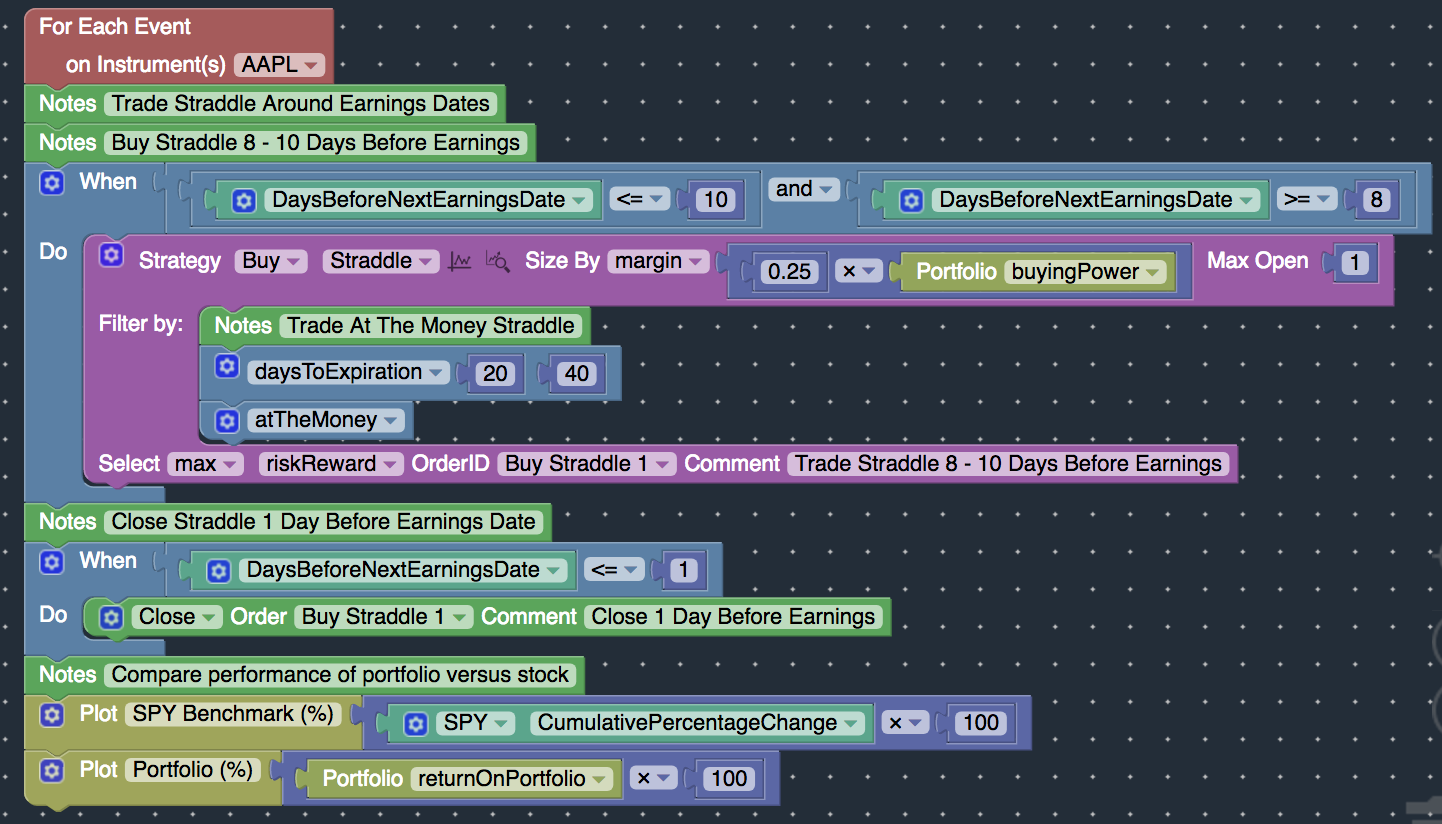

The example below demonstrates how to backtest an earnings strategy of buying at-the-money (ATM) straddles 8 – 10 days before earnings, and closing the straddles 1 day before earnings.

In this example, the DaysBeforeNextEarningsDate study was used to buy straddles 8 – 10 days before every earnings announcement.

The DaysBeforeNextEarningsDate study automatically calculates the number of days until the next earnings announcement.

To view the performance of this strategy or to create your own earnings strategy, sign up today and then click the “Run Backtest” button.