How Can We Help?

Configure Backtest Settings

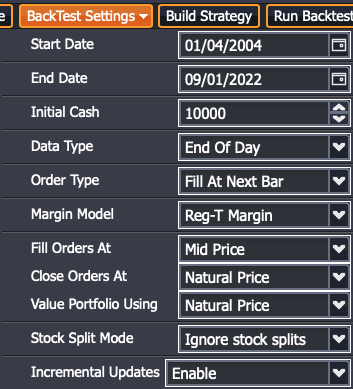

The Backtest Settings is used to configure the runtime settings of your backtests.

- Start Date: Configure the start date of your backtests. The available start date range will depend on which plan you have purchased.

- End Date: Configure the end date of your backtests. The available end date range will depend on which plan you have purchased.

- Initial Cash: Configure the initial cash balance / size of your starting portfolio. This amount will be used to calculate ROI metrics and position sizing based on portfolio size.

- Data Type: Configure which data type to use. (i.e. End of Day, Intra-Day [5 minutes], etc.) The available data types will depend on which plan you have purchased.

- Order Type: Configure how to execute your orders.

- Fill Instantly: Execute orders at the same bar / tick as when a trading signal occurs.

- Fill At Next Bar: Execute orders at the next bar / tick when a trading signal occurs.

- Margin Model: Configure how to calculate the margin used for your trades. This is used for calculating margin-based ROI metrics, as well as position sizing based on available buying power.

- Fill Orders At: Configure the opening slippage costs. Choose whether to fill your opening orders at Mid Price or Natural Price.

- Mid Price: Buy and sell at the average of bid price and ask price.

- Natural Price: Buy at the ask price, sell at the bid price.

- Close Orders At: Configure the closing slippage costs. Choose whether to fill your closing orders at Mid Price or Natural Price.

- Mid Price: Buy and sell at the average of the bid price and ask price.

- Natural Price: Buy to close at the ask price, sell to close at the bid price.

- For example, you can open orders at mid price and then close orders at natural price, or any other combination.

- Value Portfolio Using: Configure the amount of slippage to use for evaluating your portfolio / position metrics. (profitLoss, returnOnCostBasis, returnOnMaxRisk, etc).

- Mid Price: Evaluate open positions at the average of the bid price and ask price.

- Natural Price: Evaluate open positions at the natural price (buy to close at the ask price, sell to close at the bid price).

- If you configure “Close Orders At Natural Price”, you should configure also “Value Portfolio Using Natural Price”.

- Stock Split Mode: Configure whether to ignore stock splits or abort the backtest when a stock split is detected.

- In order to properly handle stock splits, your backtest should not have any open positions during a stock split event.

- To accommodate for stock splits, you can either 1) divide up your backtests into multiple date ranges that avoid the split event date or 2) you can close all open positions prior to the stock split event, and re-establish the positions after the stock split event. See FAQ for more information.

- Incremental Updates: Configure whether to receive incremental status updates on your backtests or to receive only the final results at the end of your backtests. If your browser hangs or runs out of memory during the backtests, you should disable incremental updates.