How Can We Help?

Strategy Block

Overview

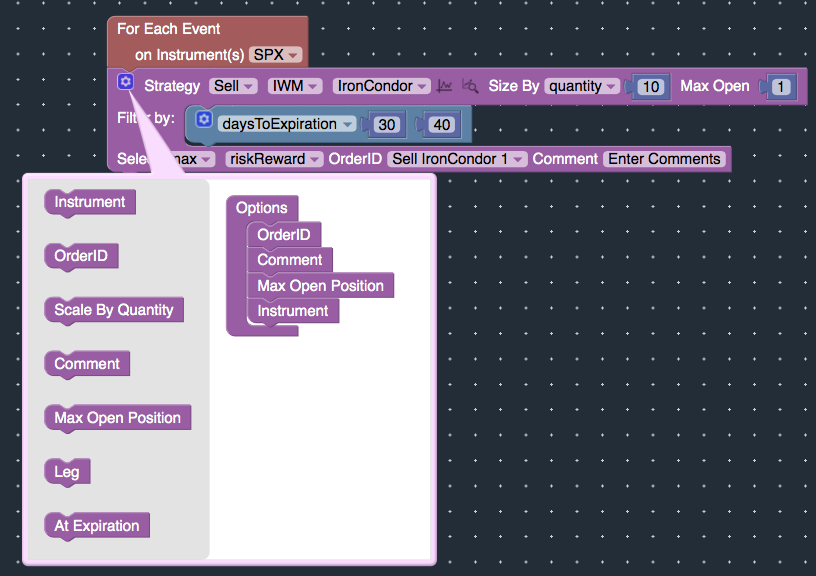

The Strategy Block is used to define the stock and option strategies to trade. It contains various features that will allow you to customize your trades to your specific requirements.

Available Strategies

Strategy: Define whether to buy / sell different strategies, including but not limited to the following:

- Long / Short stock

- Call Option / Put Option

- Covered Call

- Married Put

- Straddle / Strangle

- Collar

- Vertical Spread

- Bull Call Spread, Bear Call Spread

- Bull Put Spread, Bear Put Spread

- Put / Call / Iron Butterfly

- Put / Call / Iron Condor

- Put / Call Calendar

- Put / Call Ratio

- Put / Call Diagonals

- Unbalanced Butterfly

- Unbalanced Iron Condor

Max Open: Define how many concurrent open positions to trade at any given point in time. For example, if Max Open is 1, only one position will be traded at a time. Before a new position is opened, the old position will have to be closed / expired first.

Comments: Add your custom comments to the position. Comments are useful when analyzing your backtest results, allowing you to trace which transactions were executed by which Strategy block.

Ranking

RankBy Risk-Reward / Cost Basis: By default, when multiple positions satisfy your requirements, only the first few matches will be evaluated. You can define which of the first few matches to select based on metrics such as risk-reward or cost-basis.

If you would like to evaluate and rank all possible matches (instead of just the first few matches), please upgrade to our Institutional Plans.

- Risk-Reward: calculated as (Max Profit divided by Max Loss). Risk-Reward should only be used if the spread has a defined risk-reward (i.e verticals, iron condors, etc). If the risk / reward is undefined (i.e. buy call / sell call, etc.), cost-basis should be used instead.

- Cost Basis: calculated as the amount of cash debited / credited. Selling spreads usually results in cash credit, while buying spreads usually result in a cash debit.

- Some examples:

- If you are buying a call option, you can define min cost-basis to select the lower cost call option that satisfies your requirements. Or if you are selling a call option, you can define max cost-basis to select the higher cost option to sell.

- If you are selling an iron condor, you can define max risk-reward to select the iron condor with the higher risk-reward ratio. Or you can define max cost-basis to select the iron condor that has the higher premium received from the sale.

Position Sizing

Size By: Define how to size your order at trade entry. You can use different metrics to size your trade, including:

- cost – size by the cost of the position

- debit – size by the amount of debit. Used for strategies that results in a debit (buy put, buy stock, etc)

- credit – size by the amount of credit. Used for strategies that result in a credit (selling put, short stock, etc)

- margin – size by the amount of margin for the trade.

- quantity – size by the number of contracts

- risk – size by the max risk of the position

- delta – size by the target delta of your position. Be sure to specify whether delta should be positive or negative.

Filtering

Filter By: Define the specific requirements of the position, such as days to expiration, target delta, etc.

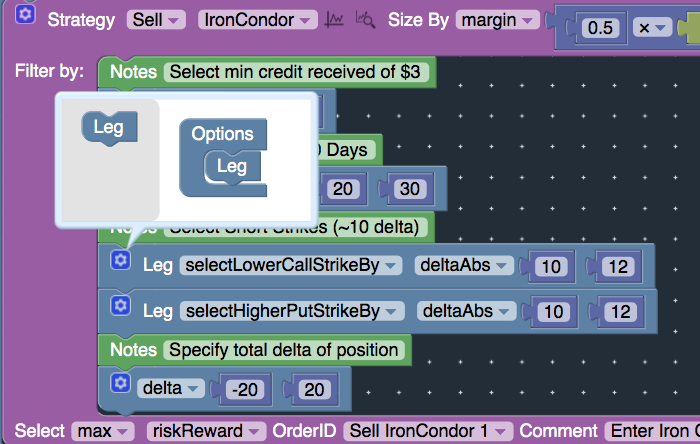

You can define strategy filters that apply to the entire position as a whole (such as net delta of the overall position), or define strategy filters that only apply to a certain leg of the position (such as delta of the short strike)

By default, the strategy filters apply to the entire order. But you can apply the filters to a specific leg of the order by enabling the “Leg” option under the “Gear” icon of the filter blocks. For example, the Strategy block below will define an Iron Condor where the short strikes are 10 – 12 delta, but the overall net delta of the iron condor should be between -20 / +20 delta.

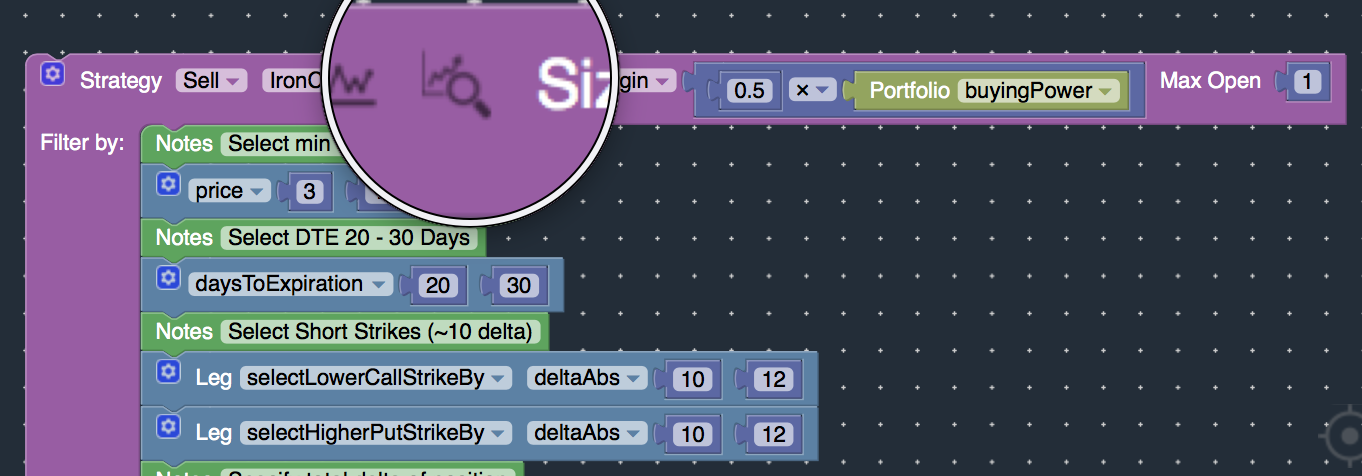

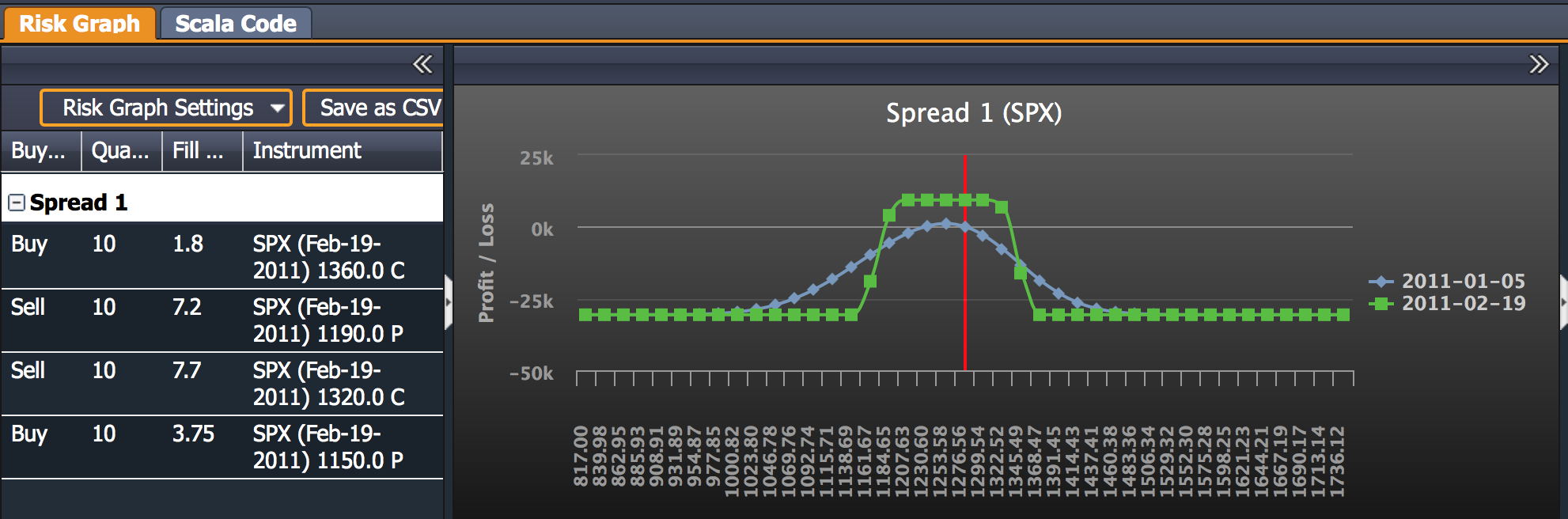

Preview Trade

Once you’ve defined your requirements, you can click on the “Magnifying Icon” to preview the trade.

If there are positions that satisfy your requirements, the matching positions will be displayed for your review. However, if no positions satisfy your requirements, you may want to adjust your strategy filters / criteria to be more inclusive and / or change the date of evaluation. Please see the Debugging Guide for more info.

If you are using the SetVariable block as part of your strategy filters, previewing the trade is a little more complex. Please see Debugging Variables for more info.

Advanced Options

The Strategy Block contains Advanced Options that can be enabled by clicking on the “Gear” icon.

Expiration Behavior

At Expiration: Define expiration behavior. You can close the position at expiration, or allow the position to be exercised / assigned at expiration.

- If exercise / assignment is selected, long in-the-money options will be automatically exercised and short in-the-money options will be automatically assigned.

- If close at expiration is selected, the positions will be automatically closed on the last trading day of the instrument preceding expiration. Options which are long will “sell to close” and options which are short will “buy to close”.

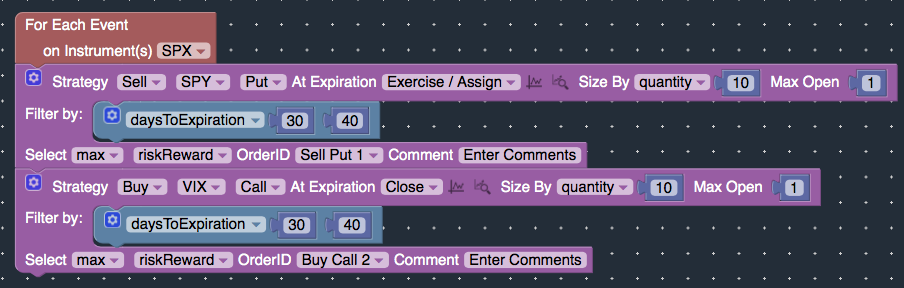

Multiple Instruments

Instrument: specify a different instrument to trade, compared with the main instrument defined. In fact, you can trade multiple instruments by defining a different instrument per Strategy block.

- For instance, in the example below, the main instrument is SPX, but a naked put will be sold on the SPY, and a call option will be bought on the VIX. The short SPY put will be exercised / assigned at expiration, while the VIX call option will be closed at expiration.