How Can We Help?

Studies Block

The Studies blocks are used to defined your entry / exit conditions for your trades. You can select from hundreds of market-related conditions or portfolio-related conditions.

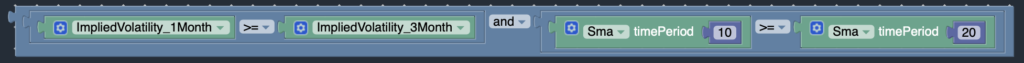

For example, you can sell a bull put spread when Implied Volatility is near a high but closing prices are near a low, and close the trade when the position has made 50% profit.

Market Studies Block

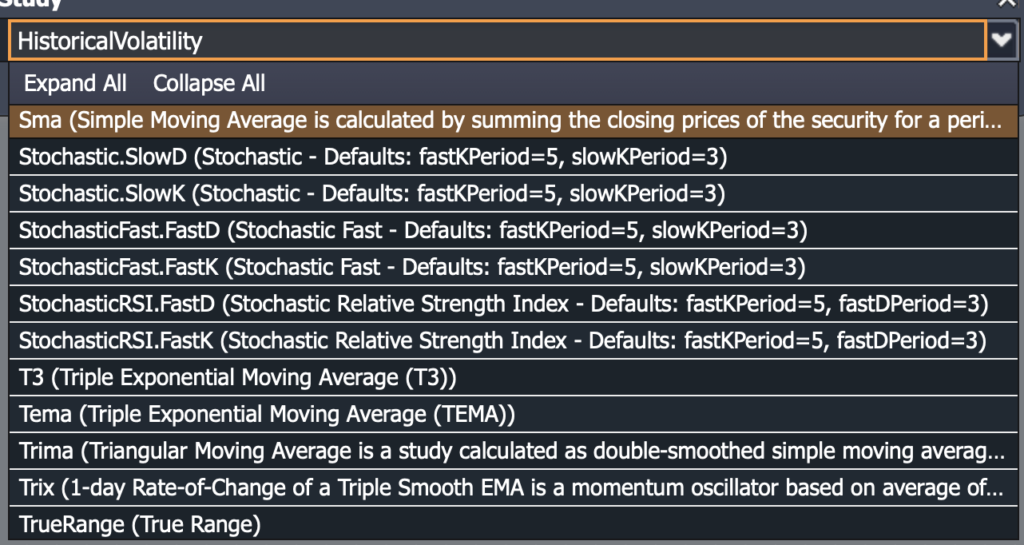

The Market Studies block contains hundreds of market-related studies. Market studies include stock-related technical analysis studies such as Bollinger Bands, RSI, Moving Averages, etc. Market studies also includes stock-related volatility studies (Implied Volatility, Historical Volatility, Average True Range, etc), and earnings-related studies.

In addition, beyond stock-related studies, there are option chain related studies, such as analyzing the price of at-the-money straddles, delta / IV of at-the-money call options over time.

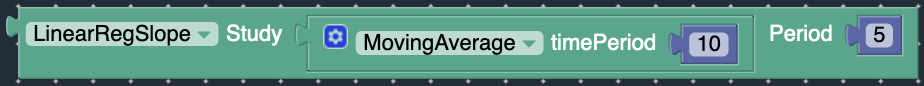

The output of one study can be used as the input into another study, such as calculating the Percentile Rank of Implied Volatility, the Rank of Closing Prices over a 1 year period (i.e. 52-week high), or the Slope of the 50-day Moving Average.

The Market Studies block is often used with the Comparison Block and the Logic block to define multiple market conditions that are used as part of the WHEN block.

Portfolio Studies Block

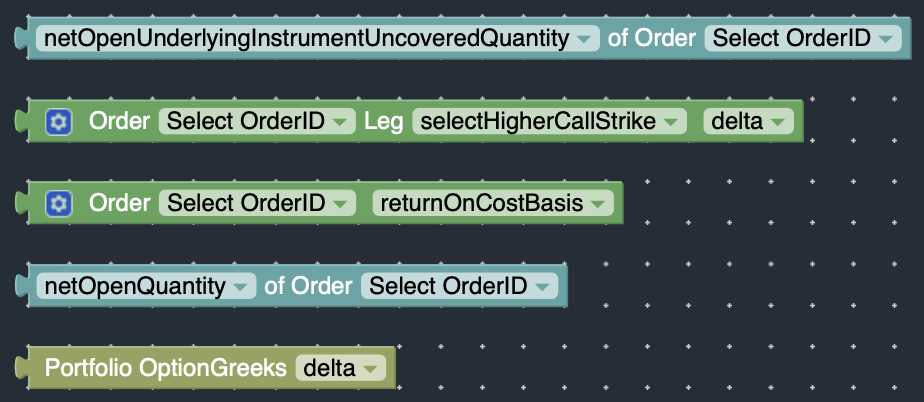

The Portfolio Studies Block contains several methods to calculate the statistics of the portfolio, including statistics on a single position in the portfolio, a specific leg of a position in the portfolio, or the overall portfolio itself.

Statistics include profit / loss, option greeks (i.e. delta), ROI, break even points, net open contracts, number of assigned shares of stock, etc.. In addition, the portfolio studies block can be used to determine the number of open contracts and whether a position has been exercised / assigned.

The Portfolio Studies block is often used with the Comparison Block and the Logic block to define multiple market conditions that are used as part of the WHEN block.

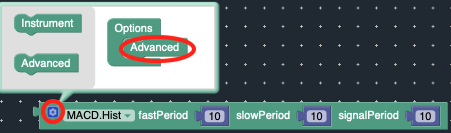

Advanced Options

If you want to adjust the default parameters of the Studies, you can enable the Advanced Options (click on Gear icon). For example, some studies such as MACD, Stochastic, etc, have several default parameters that can be adjusted.