The Strategy Block is used to define the stock and option strategies to trade. Using the Strategy Block, you can trade a variety of supported stock and option strategies, including but not limited to:

- Long / Short stock

- Call Option / Put Option

- Covered Call

- Married Put

- Straddle / Strangle

- Collar

- Vertical Spread

- Put / Call / Iron Butterfly

- Put / Call / Iron Condor

- Put / Call Calendar

- Put / Call Ratio

- Put / Call Diagonals

- Unbalanced Butterfly

- Unbalanced Iron Condor

Strategy Block

The Strategy Block contains various features that will allow you to customize your trades to your specific requirements.

Strategy: Define whether to buy / sell different strategies, such as put options, strangle, butterfly, iron condor, etc…

Size By: Define how to size your order at trade entry. You can use different metrics to size your trade, including:

- cost – size by the cost of the position

- debit – size by the amount of debit. Used for strategies that results in a debit (buy put, buy stock, etc)

- credit – size by the amount of credit. Used for strategies that result in a credit (selling put, short stock, etc)

- margin – size by the amount of margin for the trade.

- quantity – size by the number of contracts

- risk – size by the max risk of the position

- delta – size by the target delta of your position. Be sure to specify whether delta should be positive or negative.

Max Open: Define how many concurrent open positions to trade at any given point in time. For example, if Max Open is 1, only one position will be traded at a time. Before a new position is opened, the old position will have to be closed / expired first.

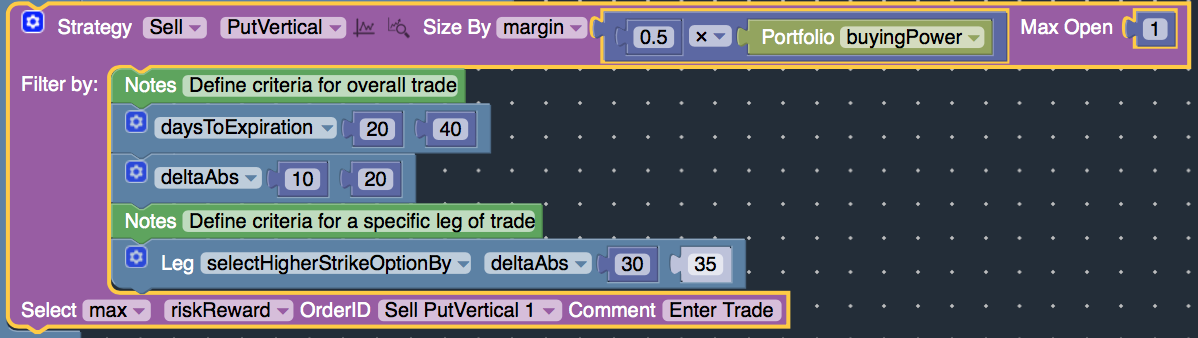

Filter By: Define the specific requirements of the position, such as days to expiration, target delta, etc. The requirements can apply to the entire position as a whole, or can apply to a specific leg in the position. (More details below)

Comments: Add your custom comments to the position. Comments are useful when analyzing your backtest results, allowing you to trace which transactions were executed by which Strategy block.

RankBy Risk-Reward / Cost Basis: In the instance that multiple positions satisfy your requirements, you can define which position to select based on metrics such as risk-reward or cost-basis.

- Risk-Reward: calculated as (Max Profit divided by Max Loss). Risk-Reward should only be used if the spread has a defined risk-reward (i.e verticals, iron condors, etc). If the risk / reward is undefined (i.e. buy call / sell call, etc.), cost-basis should be used instead.

- Cost Basis: calculated as the amount of cash debited / credited. Selling spreads usually results in cash credit, while buying spreads usually result in a cash debit.

- Some examples:

- If you are buying a call option, you can define min cost-basis to select the lower cost call option that satisfies your requirements. Or if you are selling a call option, you can define max cost-basis to select the higher cost option to sell.

- If you are selling an iron condor, you can define max risk-reward to select the iron condor with the higher risk-reward ratio. Or you can define max cost-basis to select the iron condor that has the higher premium received from the sale.

Filter By

The Filter By section of the Strategy Block allows you to define the exact requirements of your trade. You can define strategy filters that apply to the entire position as a whole (such as net delta of the overall position), or define strategy filters that only apply to a certain leg of the position (such as delta of the short strike)

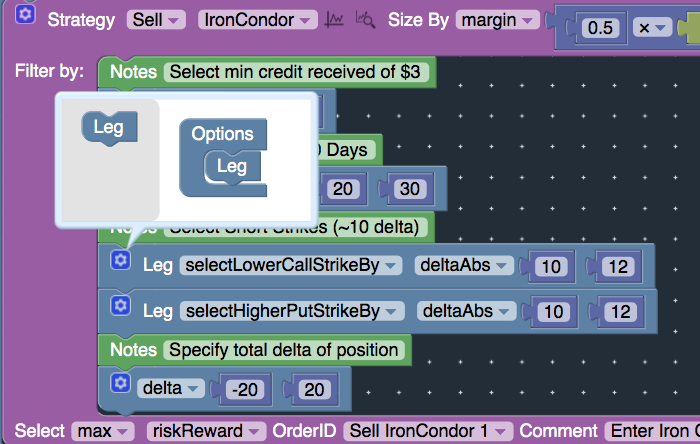

By default, the strategy filters apply to the entire order. But you can apply the filters to a specific leg of the order by enabling the “Leg” option under the “Gear” icon of the filter blocks. For example, the Strategy block below will define an Iron Condor where the short strikes are 10 – 12 delta, but the overall net delta of the iron condor should be between -20 / +20 delta.

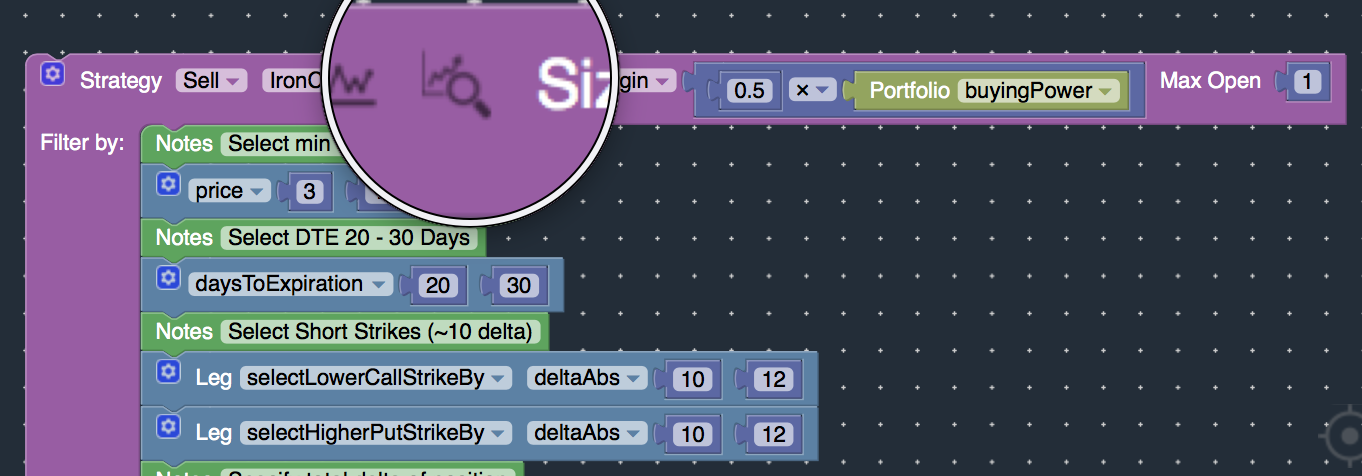

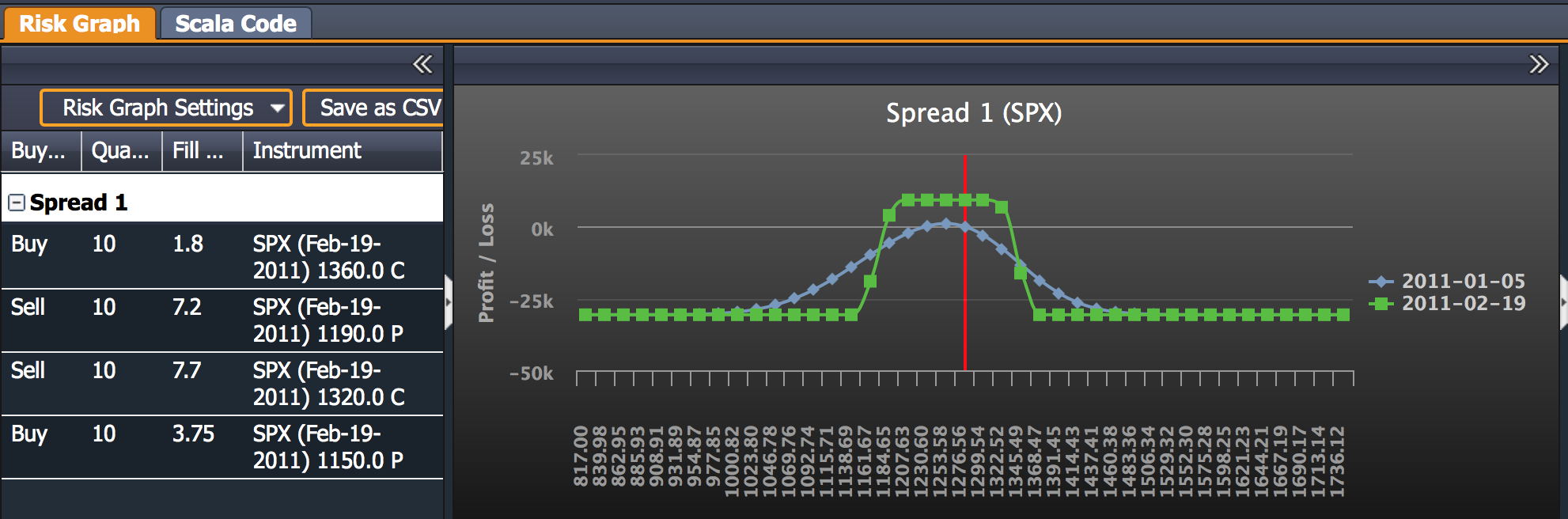

Preview Trade

Once you’ve defined your requirements, you can click on the “Magnifying Icon” to preview the trade.

If there are positions that satisfy your requirements, the matching positions will be displayed for your review. However, if no positions satisfy your requirements, you may want to adjust your strategy filters / criteria to be more inclusive and / or change the date of evaluation.

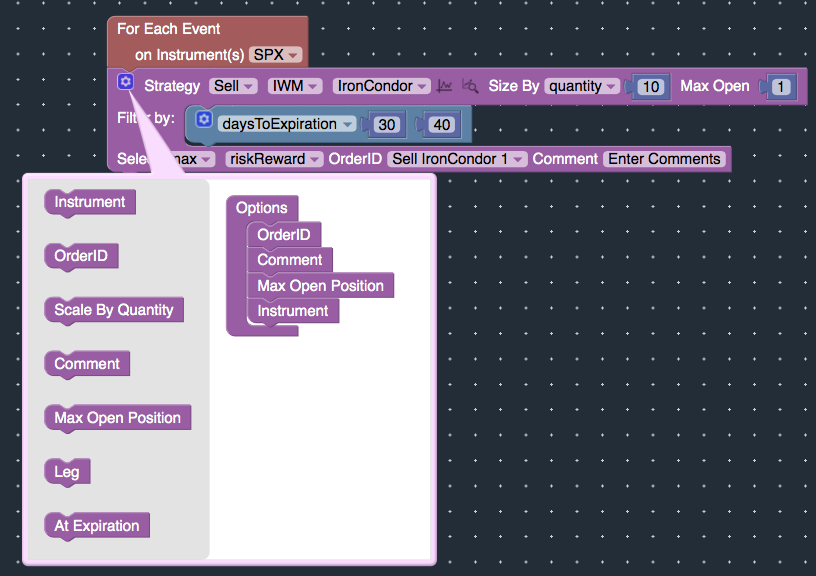

Advanced Options

The Strategy Block contains Advanced Options that can be enabled by clicking on the “Gear” icon.

At Expiration: Define expiration behavior. You can close the position at expiration, or allow the position to be exercised / assigned at expiration.

- If exercise / assignment is selected, long in-the-money options will be automatically exercised and short in-the-money options will be automatically assigned.

- If close at expiration is selected, the positions will be automatically closed on the last trading day of the instrument preceding expiration. Options which are long will “sell to close” and options which are short will “buy to close”.

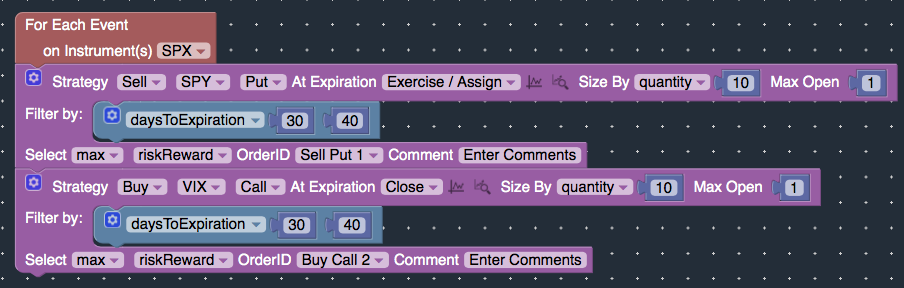

Instrument: specify a different instrument to trade, compared with the main instrument defined. In fact, you can trade multiple instruments by defining a different instrument per Strategy block.

- For instance, in the example below, the main instrument is SPX, but a naked put will be sold on the SPY, and a call option will be bought on the VIX. The short SPY put will be exercised / assigned at expiration, while the VIX call option will be closed at expiration.

Debug Your Strategy

If your strategy isn’t working as expected, please review the following guides: