In this lesson you will learn how to construct multi-legged option spreads using OptionStack’s Visual Spread Builder tool.

Specifically, we will demonstrate how to construct bearish put vertical spreads (Bear Put Spreads) to take advantage of a decline in the stock price.

Although this example demonstrates a Bear Put Spread, the same techniques can be used to construct any option spreads, such as straddles, butterflies, condors, calendars, diagonals, etc.

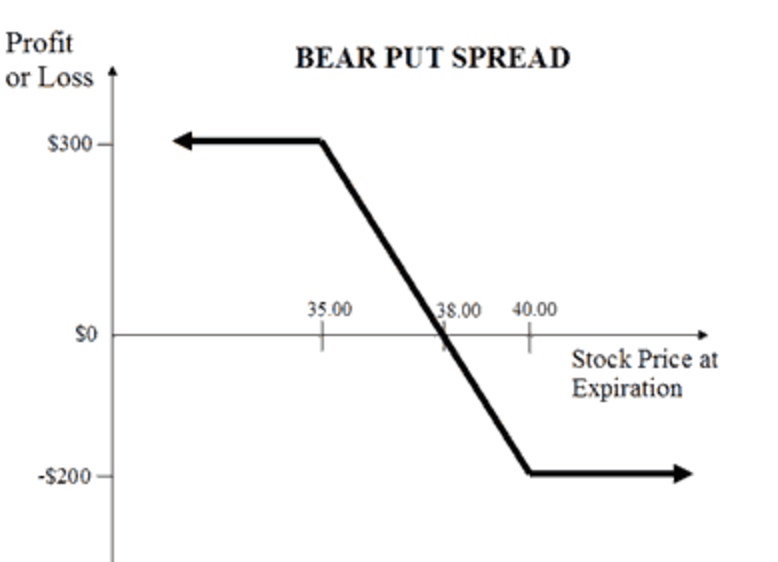

Bear Put Spread

A Bear Put Spread is an options strategy that involves purchasing put options at a specific strike price while also selling the same number of puts of the same asset and expiration, but at a lower strike price.

- We will be using our Visual Interactive Development Environment (IDE) to create and customize our vertical spreads with a few clicks of the mouse.

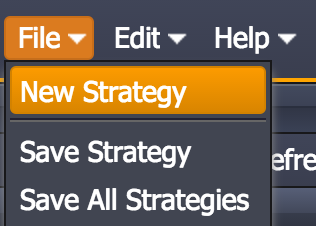

- First, login to the OptionStack platform. Select “New Strategy” from the “File” menu item

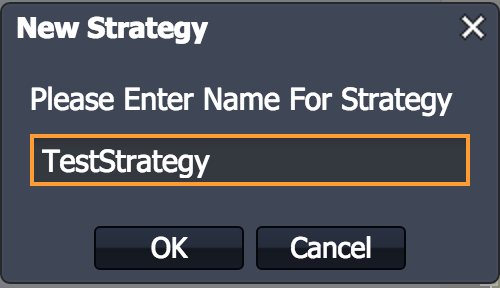

- Enter any arbitrary name you would like for the strategy

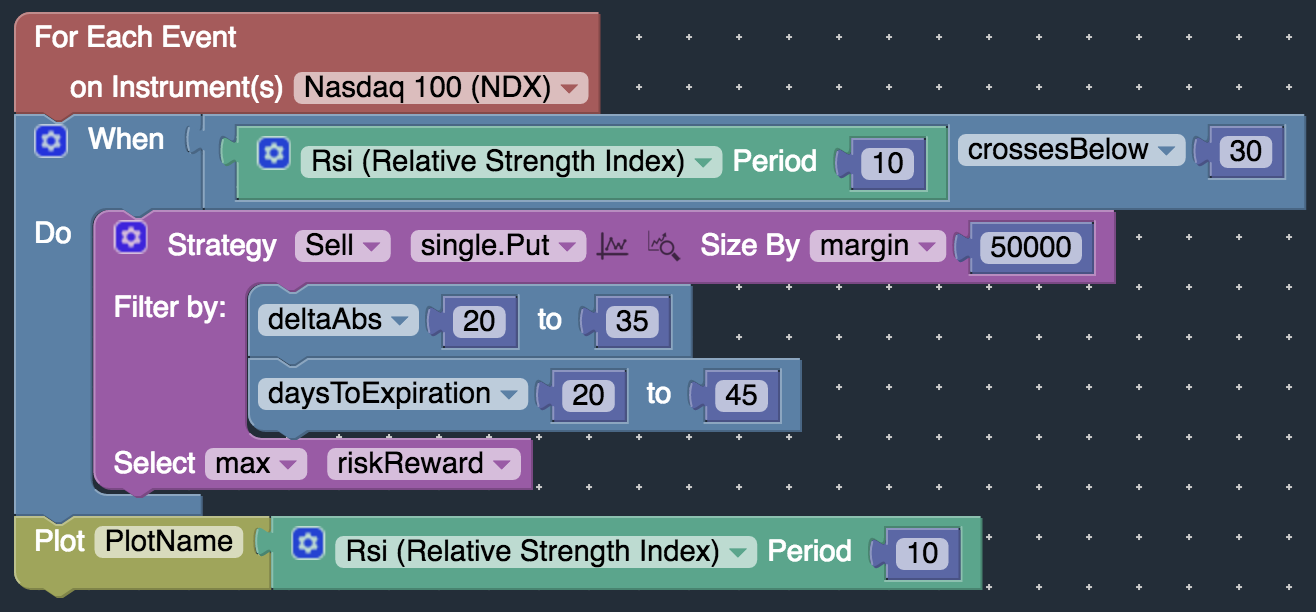

- A visual template will be automatically created for you. You will modify this template to define your trading rules.

- A Bear Put Spread is the same as buying a put vertical spread. On the other hand, a Bull Put Spread is the same as selling a put vertical spread.

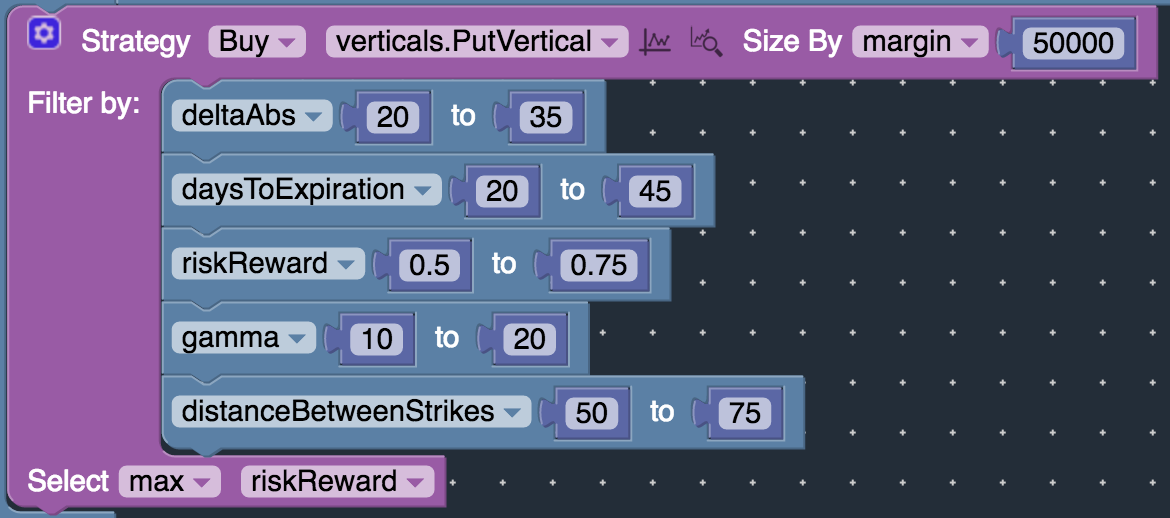

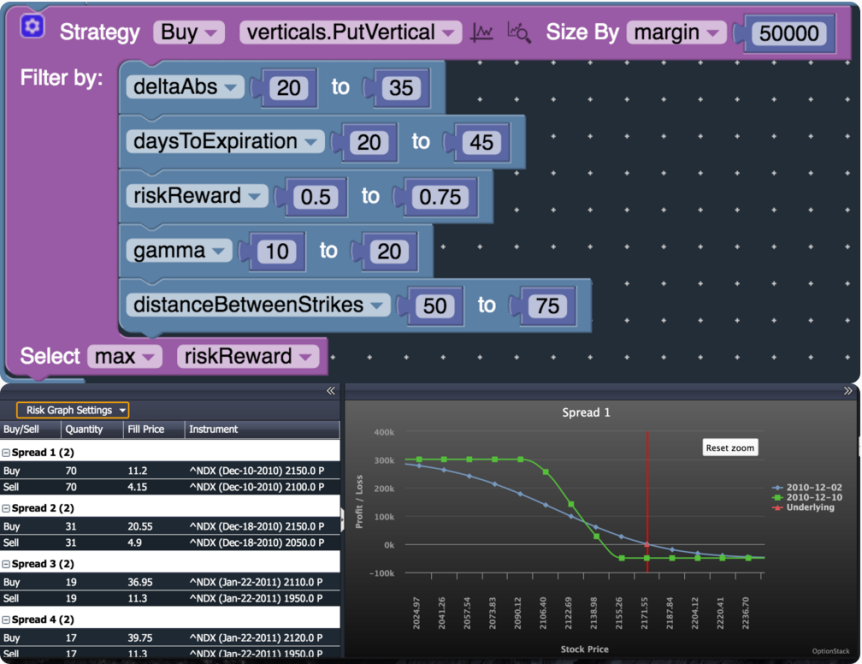

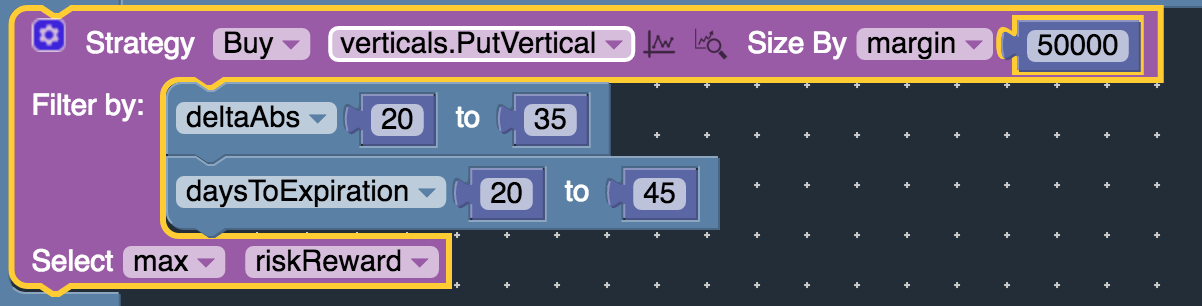

- To create a Bear Put Spread, modify the Strategy Block to select “Buy“, “Put Vertical“.

- By default, a couple of spread filters are already added, such as the days to expiration and the absolute delta of the spread. Let’s keep these default criteria and add an additional criteria.

- Let’s add a Risk / Reward filter to our Bear Put Spread, such that only Bear Put Spreads with a Risk / Reward ratio of 50% – 75% are selected.

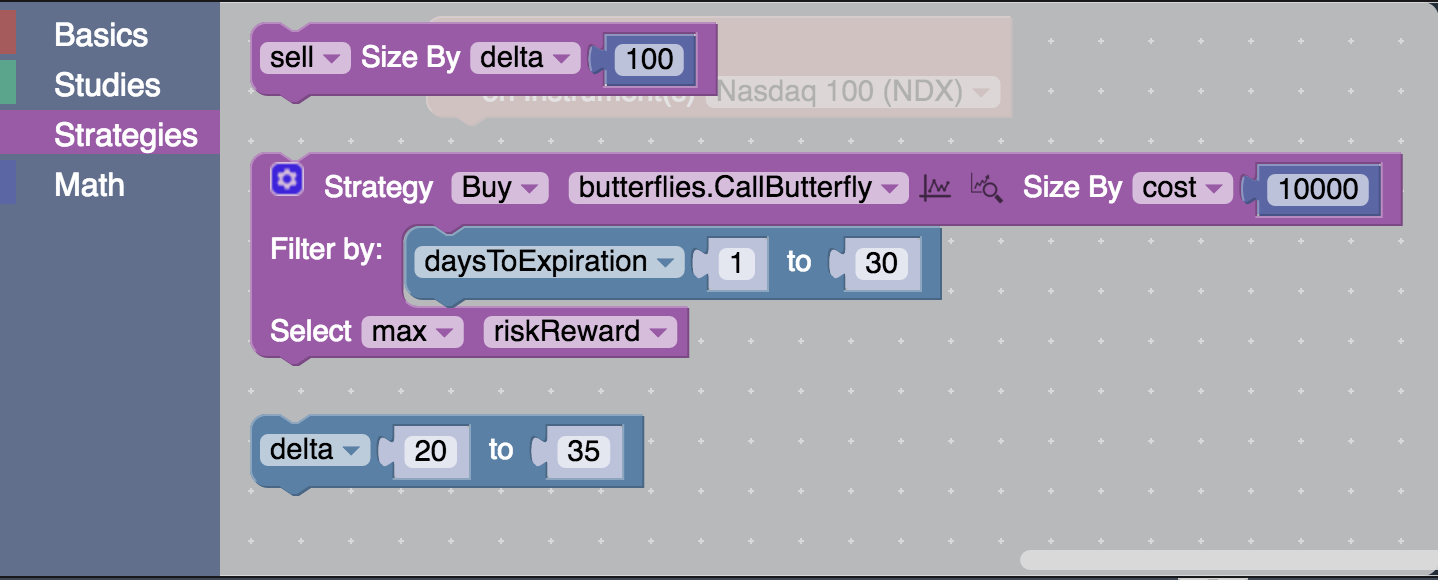

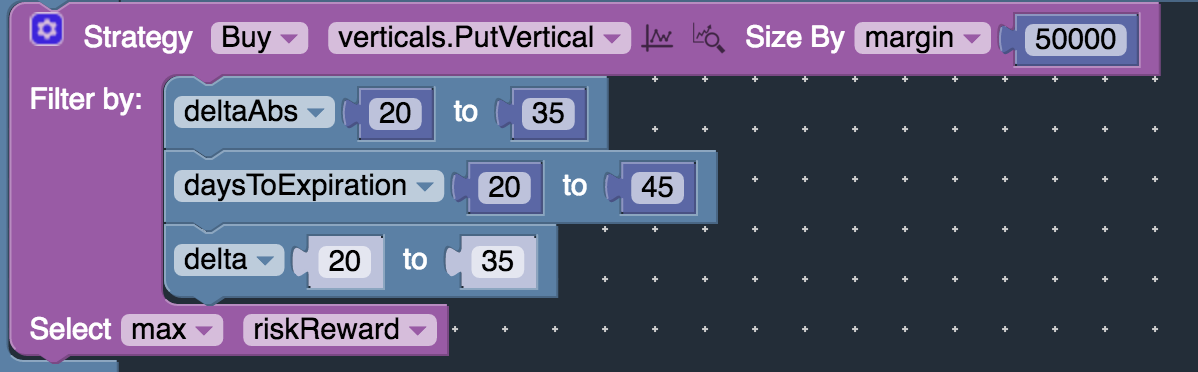

- Under the “Strategies” Toolbar, drag the “Delta” filter block from the Toolbar and drop it below the “days to expiration” block on the strategy.

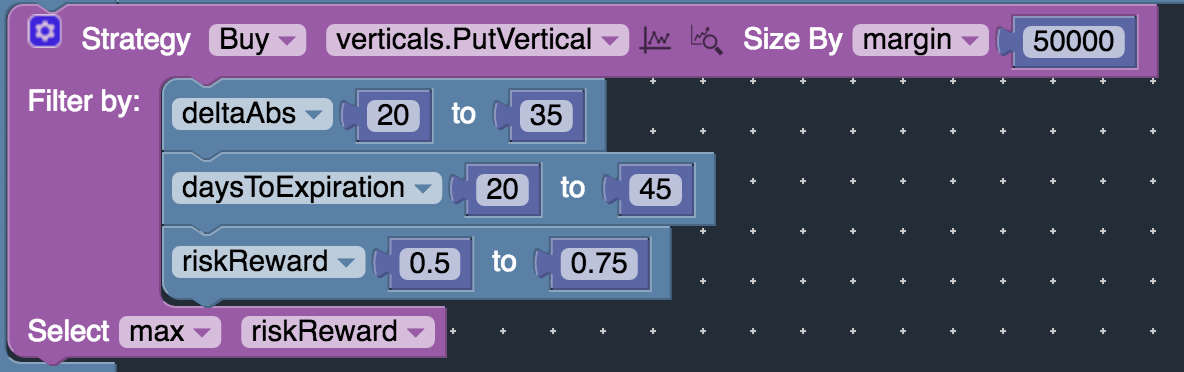

- Change the newly attached “Delta” filter block to “Risk/Reward” and enter 50% – 75%.

- This will create the following option spread:

- Buy a Put Vertical Spread with:

- 20 – 35 delta

- 20 – 45 days to expiration

- 50 – 75% risk / reward ratio

- Position sizing will be based on a 50K margin.

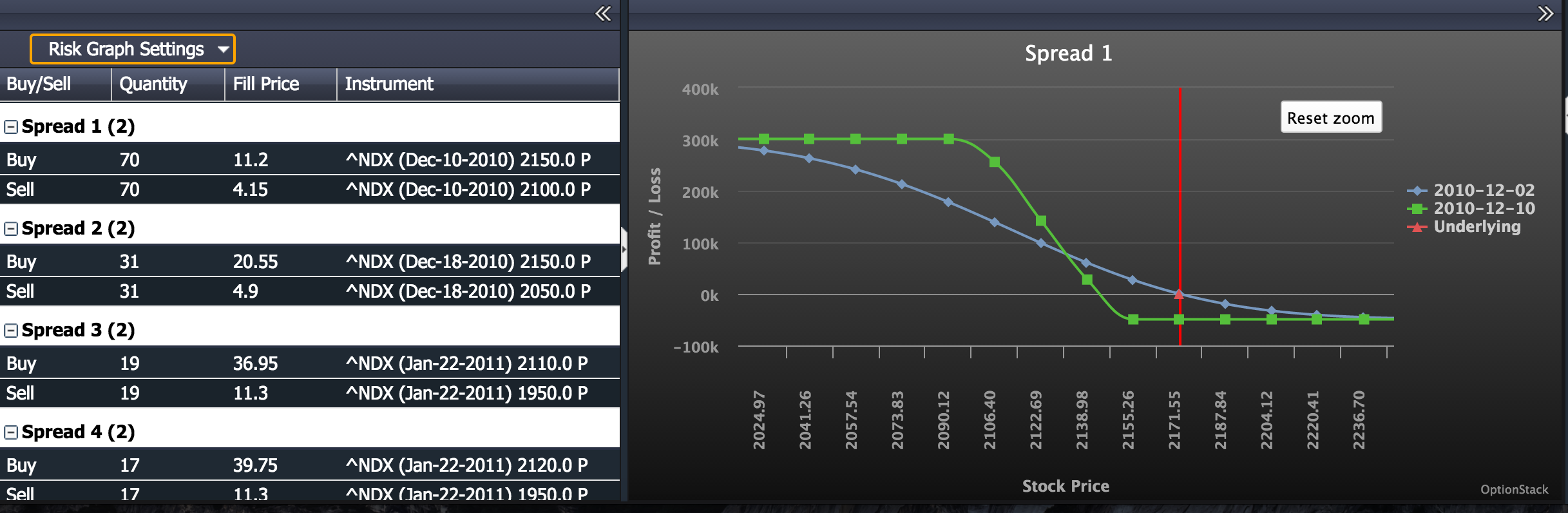

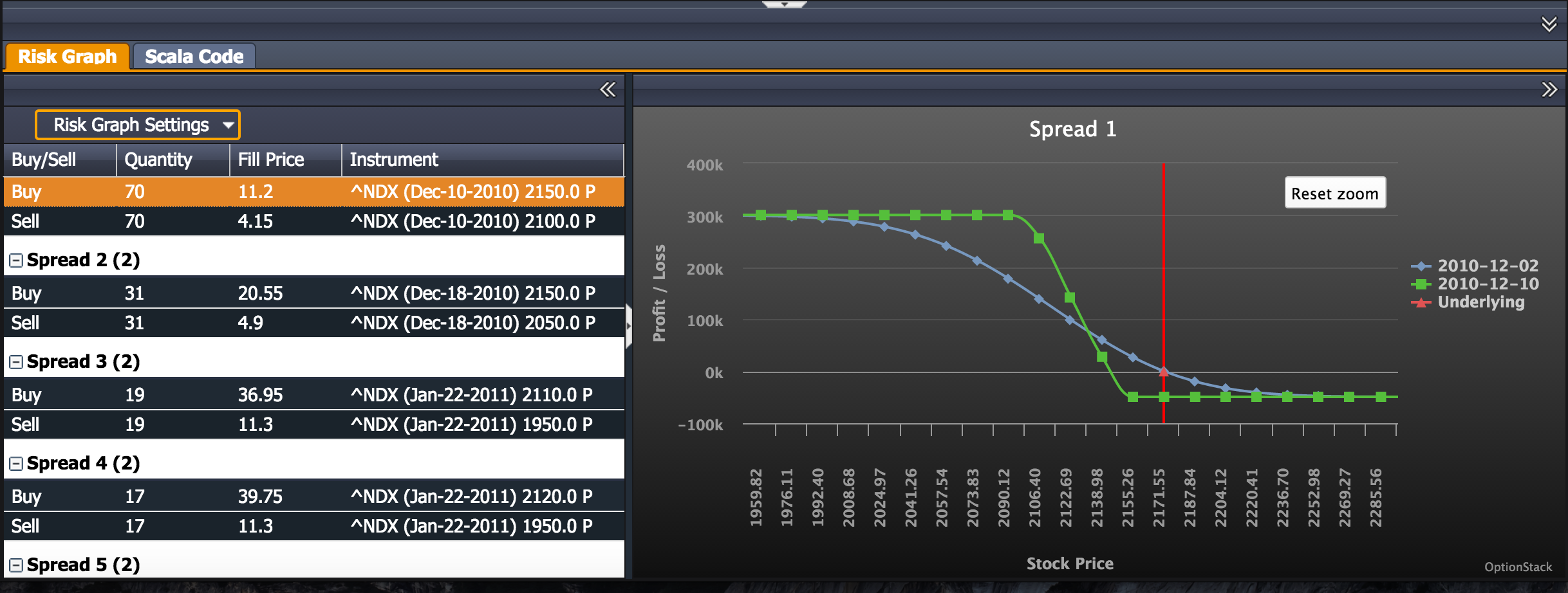

Next, click on the “Evaluate” icon (on the Strategy block) to preview a list of Bear Put Spreads that match these specified criterias.

- A list of matching Bear Put Spreads will be displayed in the lower panel.

- 20 – 35 delta

- 20 – 45 days to expiration

- 50 – 75% risk / reward ratio

- Position sizing will be based on a 50K margin.

- Double click on any of the spreads in the list to bring up the Option Chain Table for that spread. This will allow you to examine the candidate spreads in greater detail.

- Repeat the process of adjusting your strategy spread filters and reviewing the resulting matching spreads to tune your trading strategies.